One of the most significant hurdles in implementing blockchain technology has been the need to convince the financial industry to adopt this new system. Société Générale – SFH is an example of how traditional finance can be taken over by decentralized applications. They are collaborating with MakerDAO to provide loans for people who need them, while also giving access to MakerDAO holders. This is a great example of how the lines between traditional finance and decentralized finance are being blurred.

Blockchain-Powered Real Estate Refinancing Is Here

Société Générale – Forge and Maker DAO collaborated to refinance real estate bonds issued by Société Générale – SFH, marking the refinement of the lines between traditional and decentralized finance.

A collaboration proposal was published on the MakerDAO governance forum by Société Générale – Forge, a subsidiary of Société Générale dedicated to blockchain-related projects. A refinancing of Société Générale real estate bonds represented by tokens was the purpose of the meeting.

A MakerDAO account offers its users the ability to incur debt against collateral, similar to a line of credit in a traditional financial institution. In smart contracts, collateral can be deposited in the form of crypto assets such as bitcoin or ether. Loan to Value (LTV) refers to the amount of collateral deposited by the borrower that is matched against a dollar-indexed stablecoin, DAI.

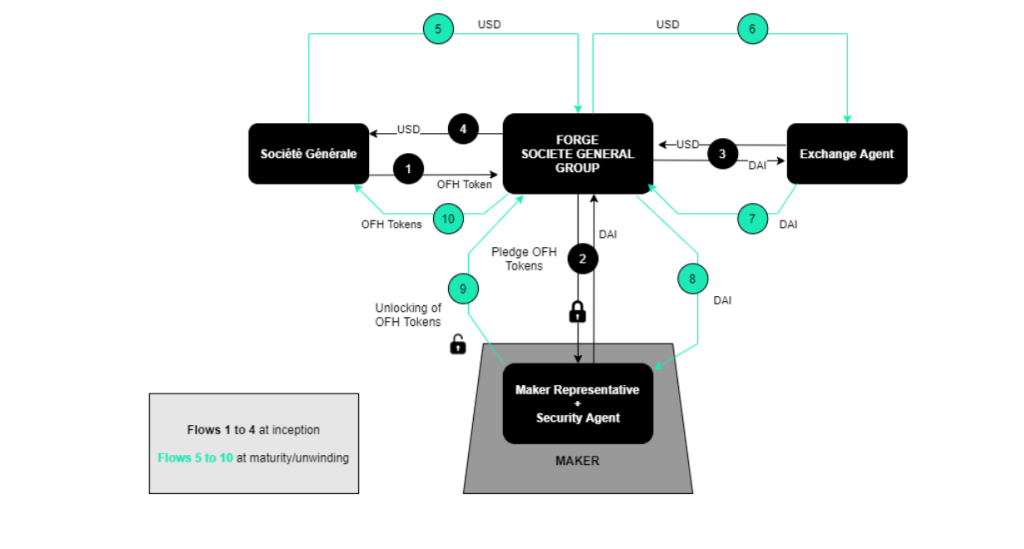

Using this collaboration proposal, the Société Générale group aims to allow holders of OFH tokens, which represent obligations backed by real estate loans, to deposit those tokens on the Maker protocol in order to borrow DAI tokens: it is an issue of refinement.

In combining traditional finance with decentralized finance (DeFi), this proposal paves the way for more experiments of this type. Besides refinancing the OFH token via DeFi, this experiment paves the way for the establishment of a legal structure around asset refinancing via DeFi, as well as the integration of the OFH token into the rest of the ecosystem.

OFH tokens are based on CAST, representing bonds backed by real estate loans guaranteed by Credit Logement at a rate of 0%, which were issued on 05/14/2020 and will mature in 05/14/2025. Both Moody’s and Fitch assigned this asset a AAA rating. It takes the form of a token on the Ethereum network that is divided into 400 units that can only be used by addresses that have been authorized. OTC (over the counter) trading is the only way to trade the token, rather than on decentralized marketplaces.

Essentially, mortgage loans guarantee the token’s value. The hedging reserve contains a set of real estate bonds worth up to 140% of the OFH token’s value.

In this case, Societe Generale – Société de Financement de l’Habitat will issue the token and will refinance it by borrowing dollars from SG-Forge.By borrowing DAIs from MakerDAO, SG-Forge will refinance the OFH token. DIIS Group is the Security Agent, or trustee under French law, tasked with recovering Security Tokens in the event of a liquidation.

A MakerDAO exchange agent is responsible for converting DAIs for dollars on behalf of SG-Forge in potential contracts involving MakerDAO and the SG-Forge community under French law.

The experiments are initiated bySociété Générale refinancing Security Tokens with SG Forge, which borrows DAI against pledged Payment Tokens, and this pledge is managed by the Security Agent.

SG-Forge exchanges DAI for dollars with the Exchange Agent

SG-Forge transmits the dollars to Société Générale

After the experimentis complete, SG-Forge repays its debt in dollars to Société GénéraleSG-Forge exchanges the dollars for DAIs with the Exchange AgentSG-Forge repays its debt in DAI in order to recover the collateral, the OFH tokensSG-Forge transfers the OFH tokens to Société Générale.

The Security Officer checks the value of the OFH tokens on a daily basis to make sure the collateral covers the DAI debt for the duration of the experiment. SG-Forge has 5 days after the collateral is no longer sufficient to cover the debt to add OFH tokens as collateral, or to repay part of the debt. After these 5 days, a liquidation notice is sent to SG-Forge, and three options are available:

As a result, the entire operation is complete: SG-Forge reimburses the DAI debt and recovers the collateral, and the Company is free to exit the business.

Translation results

SG-Forge and the Security Agent are the only agents who are able to use the OFH token, which is a registered asset. Token pledging is yet to be fully defined in its technical details, but two options seem favored: through the Security Officer or through an intermediary. MakerDAO can then remit the OFH tokens through a dedicated contract to the Security Officer, or the officer can create an ERC20 token representing the OFH tokens he receives.

What will happen to the debt in DAI?

In order to attract investors to their bond products, bond refinancing is necessary. This also makes it possible to diversify the financing of structured products incorporating this type of bond through DeFi. It is with this in mind that this experiment was set up, the borrowed DAIs will therefore be transferred to Société Générale in order to validate the entire process, before opening it to their customers.

In fact, the liquidation process is not yet smooth as it relies on a trusted third party: the Security Agent. This experiment is only a first step since some points of friction are still present. In fact, he is responsible for liquidating SG-Forge’s position if OFH tokens are no longer sufficient to cover the DAl debt. This type of liquidation is usually carried out by anyone possessing or borrowing the funds. Thus, setting up a liquidity reserve using OFH tokens in a decentralized exchange such as Uniswap or Sushiswap would be one way to go. These exchanges also provide franchised liquidity reserves, where only authorized parties can participate.. The liquidation process could thus be opened up to more players. This poses other technical and legal challenges, in particular regarding a whitelist of authorized addresses to participate in this supposed liquidity reserve.

The tokenization of the bonds supporting the OFH token is also a concern. The transparency of this asset as a whole would be greatly improved as users of decentralized finance would have access to all of the assets that go into making up the OFH token.

In spite of its flaws, this Société Générale and MakerDAO collaboration proposal signals an opening of the frontier between traditional finance and decentralized banking, which will allow a smooth transfer of capital between the two types of infrastructure

Via this site.