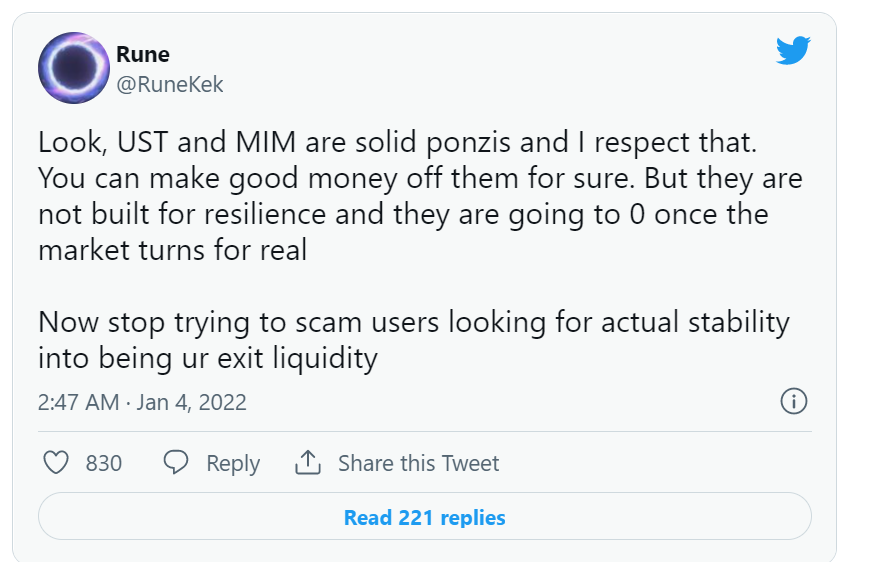

Don’t get scammed with these UST and MIM, they’re not what you think. The controversial Terra tokens have been flagged by MakerDAO Founder Rune Christensen as a “Ponzi scheme that will collapse when market conditions change.”

The developer noted that the assets are not built for “resilience” and will suffer abnormal volatility and fall to zero. In addition to this, Christensen has asked to stop scammers from using their accounts as “exit liquidity.”

Later, he said that he respected both projects for being solid Ponzi schemes and that it is possible to make some money from either project.

During a subsequent tweet, Christensen clarified that he has nothing against Ponzi schemes or high-risk assets. He suggested that everyone has a right to have “fun the way they want.”

MIM and UST – The Tokens that Will Not Withstand Market Changes?

Magic Internet Money (MIM), is a decentralized finance protocol that allows users to earn interest by depositing “Interest-Bearing Assets” into the system. To sum it up, MIM offers users a variety of well-known DeFi solutions that are widely utilized by the industry.

CreatorDAO’s developer was also drawn to Terra’s UST stablecoin, which is part of the Terra blockchain protocol, a decentralized algorithmic stablecoin. In addition to being a U.S. dollar-pegged asset, USTs are also used for borrowing and interest rate farming.

Despite their similar features, Christensen’s critique is directed at the DeFi industry as a whole, as well as the numerous projects being pushed on communities for the stable and passive income they provide.

Via this site.