Today’s news that the ethereum money markets saw record liquidations as ether tanked sent shockwaves through the cryptocurrency community.

The recent sell-off of Ether has brought pain to some and cheer to others, underlining the zero-sum nature of trading. MakerDAO collected more than $15 million in liquidation penalty fees just a few days ago.

The major cryptocurrency fell by more than 14% on Friday, its most significant single-day drop in seven months, triggering the liquidation of collateral locked in prominent Ethereum-based lending and borrowing protocols, which are also known as decentralized money markets. Decentralized finance (DeFi) applications can also generate a large amount of revenue through liquidation fees.

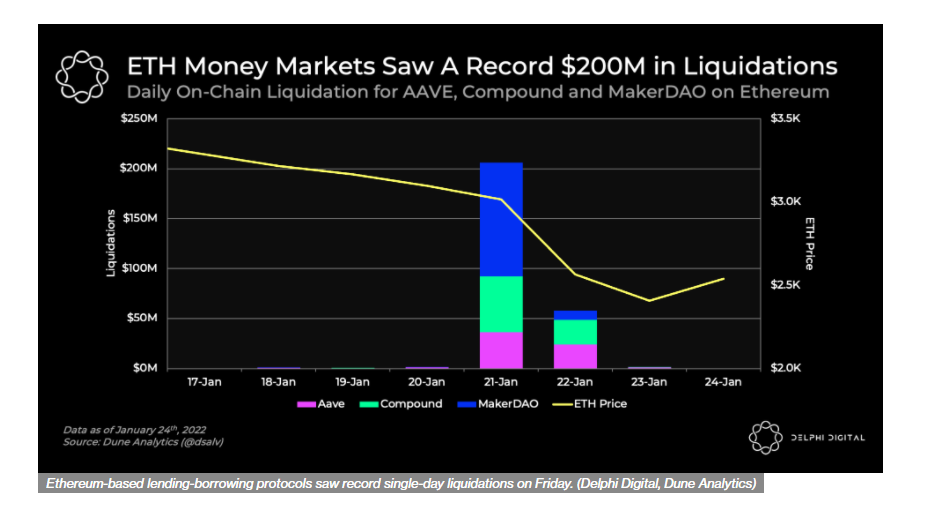

The Ethereum money markets AAVE, Compound and MakerDAO processed a total of $200 million of liquidations on Friday, according to Dune Analytics, which was shared by Delphi Digital. MakerDAO accounted for more than half of the total, Dune Analytics reports. Typically, these DeFi protocols see less than $10 million of daily liquidations.

Whenever a crypto crash lowers the value of collateral below the safety threshold, the borrower is liquidated. The process is similar to the way derivatives exchanges close positions due to margin shortages.

On Friday, MakerDAO collected about $15.5 million in liquidation penalty fees, as ETH fell from $3,200 to $2,500 following a major correction in the past week, Delphi Digital analysts wrote in a Monday newsletter. This month, DeFi protocol liquidation revenue has been $17.5 million. “That’s a multiple of the revenue generated in recent months,” Delphi Digital noted.

DAI, a stablecoin backed by U.S. dollar issued by MakerDAO, facilitates collateral-backed loans without an intermediary and is one of the most widely used coins in the DeFi ecosystem.

Users put ether as collateral on the Maker platform, opening a vault position to borrow DAI equivalent to a portion of the collateral’s value. Borrowers need to pay back the DAI along with the loan interest when they want to withdraw their collateral.

The crucial point is that Maker uses over-collateralized lending, which means that the value of ether deposited must exceed the loan amount.An individual wanting to borrow 500 DAI needs to deposit 1.5 times that amount in ETH or any other coin Maker accepts.

As soon as the collateralization ratio drops below 150%, the loan becomes uninsured, and the borrower can add more collateral, repay DAI, or get liquidated. Adding the liquidation penalty to the borrower’s total loan amount is the penalty for liquidation.

The liquidation penalty is based on a percentage of the debt. In addition to the debt ceiling, Maker also has a mechanism that controls the maximum amount of DAI that can be generated. Those who have reached the debt ceiling must pay off their existing debt before taking out more.

What Is The MakerDAO Liquidation Penalty?

Liquidation of a position involves the sale of the ETH deposited as collateral, which is then burned or destroyed. DAI’s price rises due to this, maintaining the 1:1 peg and pushing ether downward.

A large number of liquidations can therefore lead to elevated price volatility – an exaggerated decline in the value of collateral.

Seven-Siblings, the second-largest MakerDAO vault owner (or borrower), faced liquidation risk as it held more than $600 million in debt.

Ultimately, according to Delphi Digital, only $60 million of the borrower’s vault was liquidated.

Founder Shixing “Shenyu” Mao of crypto asset management platform Cobo believes a continued sell-off in ether to $1,900 and below will trigger $600 million in liquidations on MakerDAO, says China journalist Colin Wu in a tweet.

CoinDesk data shows that ETH change hands near $2,400 after hitting a six-month low under $2,200 on Monday.

Via this site.