Some people are hurting, while others are cheering. The reason for this is the zero-sum nature of trading. Recently, MakerDAO collected more than $15 million in liquidation fees to Ether trades that faltered because of its massive drop by 14% on Friday alone. As a result of these decentralized finance applications (DeFi), some Ethereum loans were also paid off as collateral was liquidated due to the cryptocurrency’s fall–leading many DeFi apps to make money via charging these very same fees!

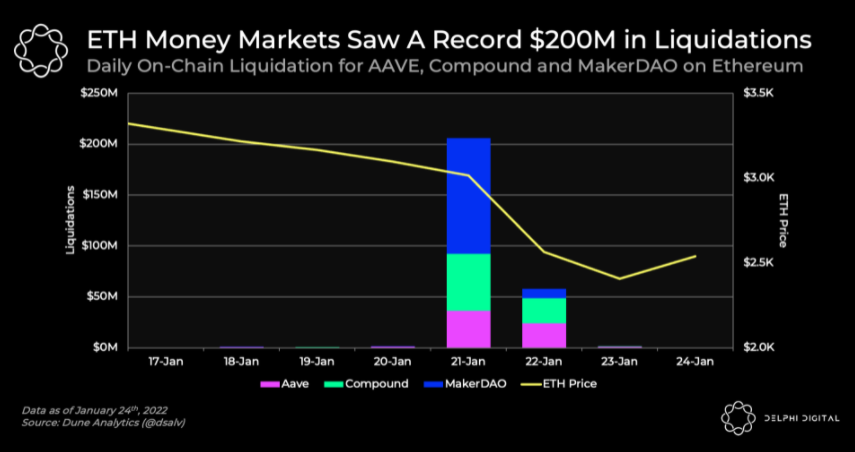

Data shared by Delphi Digital shows Ethereum money markets AAVE, Compound, and MakerDAO processed a total of $200 million in liquidations on Friday, a record for a single-day total. MakerDAO accounted for more than half of that amount. Liquidations under these DeFi protocols typically total less than $10 million per day.

The process is analogous to derivatives exchanges liquidating long and short positions due to margin shortages following a crypto crash that has pushed the collateral’s value below the safety threshold.

“As Ethereum fell from $3,200 to $2,500 in the past week, on-chain liquidations sped up as positions started getting liquidated,” Delphi Digital analysts said in their newsletter on Monday, adding that MakerDAO has profited from the correction.

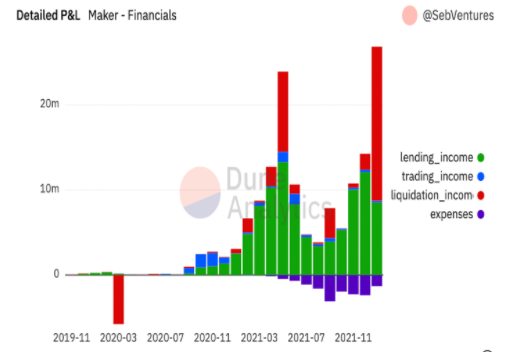

The DeFi protocol earned $17.5 million in liquidation revenue this month, according to the official forum, and MakerDAO collected about $15 million in liquidation penalty fees on Friday. Delphi Digital noted that the revenue is multiples more than recent months and surpasses the May 2021 drawdown.

Is The MakerDao “Collateralized Debt Position” System A Scam?

In addition to offering a U.S. dollar-backed stablecoin, MakerDAO provides collateral-backed loans without the need for an intermediary.

Using the Maker platform, users put ether as collateral, opening a vault position to borrow DAI equivalent to some of the collateral’s value. When the borrower wants to withdraw their collateral, they must repay the borrowed DAI, plus interest.

Maker makes use of over-collateralized lending, which means the deposited ether value must be greater than the loan amount. To borrow 500 DAI, a borrower needs to deposit 1.5 times that amount in ETH or any other coin Maker accepts as collateral.

If the collateralization ratio falls below 150%, the loan becomes unsafe, and the borrower can pay off the DAI, add more collateral, or get liquidated. When the borrower is liquidated, they must pay a penalty.

There is a liquidations penalty calculated as a percentage of the debt. Maker also has a debt ceiling, which limits how much DAI can be generated based on different collaterals. Users must pay down their existing debt before taking on additional debt if the ceiling is reached.

The MakerDao Price Floor: Why It’s Dangerous To Have A Fixed Value For A DAI/ETH Pair

The ETH that was deposited as collateral for a liquidation is sold for DAI, which then gets destroyed.

This causes ether to drop and makes it harder to pay off the debt owed from the loan or auction. In other words, high numbers of liquidations can lead price volatility in ETH’s value, which will have an effect on everything else-even if you don’t have any tokens!

Last week’s panic from Crypto Twitter started when 7-siblings faced potential loss because they were a major MakerDAO vault owner (or borrower).

After adding more collateral, Delphi Digital reports that only $60 million from the borrower’s vault were liquidated.

Shixing “Shenyu” Mao, founder of the Cobo crypto asset management platform, anticipated that a continued drop in ether to $1,900 and below would trigger $600 million in liquidations on MakerDAO, according to a tweet by China journalist Colin Wu.

Data from CoinDesk shows that Ethereum was recently changing hands near $2,400, after hitting a six-month low under $2,200 on Monday.

Via this site.