The problem with MakerDAO’s DAI is that it is a centralized stablecoin, which puts it at risk of having its stability and attractiveness compromised. DAI, once the largest decentralized stablecoin, may face an existential threat from Terra’s plans to create a new, heavily incentivized Curve Finance pool.

3pool Has A New Competitor: 4pool.

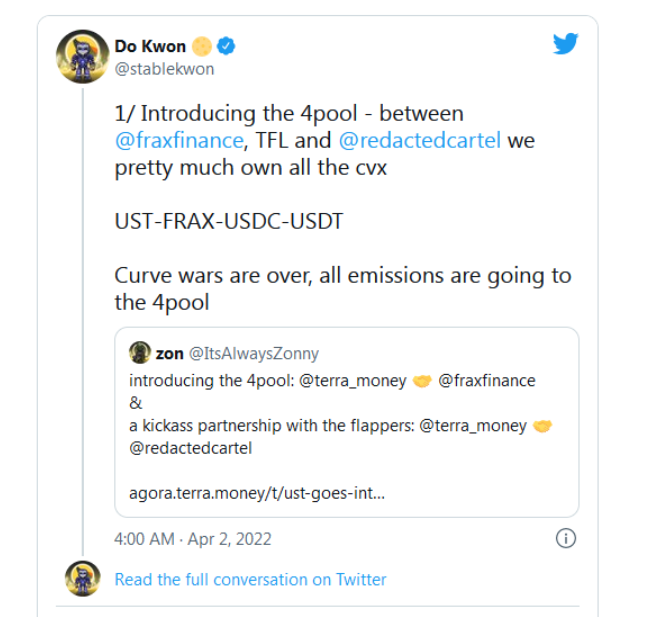

Terra plans to launch a heavily subsidized liquidity pool for its UST stablecoin on Curve Finance.The 4pool would contain UST, FRAX, USDC, and USDT instead of the currently largest stablecoin pool, 3pool.Terra’s aggressive move is all about “starving the 3pool” of liquidity, which might damage DAI’s stability and attractiveness.Terraform Labs founder and CEO Do Kwon says he plans to starve MakerDAO’s DAI of liquidity and overthrow it. Will he succeed?

Terraform Labs’ Do Kwon Aggressive Move Against MakerDao

Terra is preparing to deal a third blow to MakerDAO’s DAI after UST’s market cap more than doubled.“By my hand $DAI will die,” Terraform Labs CEO and founder Do Kwon tweeted on Mar. 23. The following week, he followed through on his open-ended threat by introducing the so-called “4pool.”

The pool would be setup on Curve Finance, the largest decentralized exchange for like-valued assets, and would consist of four stablecoins: Terra’s UST, Frax Finance’s FRAX, Tether’s USDT, and Circle’s USDC.

In this project, UST and FRAX, now allied algorithmic stablecoins, aim to create deep liquidity and starve the competing decentralized stablecoin, DAI. Liquidity refers to the amount of crypto assets available for trading on a particular trading venue.

Liquidity is essential because it determines how easily an asset can be traded for another asset without affecting its market price. Trades involving deep liquidity can be executed without incurring a loss of funds to slippage, the difference between an expected and actual price.

By making liquidity provisioning less profitable for market makers due to shallow liquidity, traders are repelled and liquidity is drained. Liquidity is important for stablecoins because it guarantees their price stability, effectively acting as a safety net for their peg. Since large traders have a greater influence on their price, stablecoins with low liquidity can lose their peg more easily.

The largest stablecoin pool is currently the so-called “3pool” on Curve, which contains USDT, USDC, and DAI and holds assets worth over $3.4 billion. 3pool has so far been able to guarantee deep liquidity for so-called whales, or high-net-worth individuals, so that they could execute massive swaps between DAI and other stablecoins without incurring slippage or destabilizing its peg.r, threatens to disrupt this.

Curve’s Governance Partnership

As things stand, decentralized exchanges reward liquidity providers with tokens to ensure liquidity. CRV, Curve’s native token, is used to reward liquidity providers. The CRV token holders can participate in Curve’s governance and control the protocol’s token emission through a process known as “vote locking,” meaning they can influence the allocation of rewards to specific pools of their choosing.

Terra recently acquired a majority stake in Curve’s governance by partnering with Frax, BadgerDAO, OlympusDAO, Tokemak, and the influential meta-governance protocol Redacted Cartel. By redirecting liquidity rewards away from the 3pool to its own 4pool, it is able to influence CRV token emission. This is a bad thing for DAI, since the 3pool is crucial for liquidity.

Kwon believes the explicit objective of this aggressive move is to acquire liquidity for Terra’s flagship stablecoin, UST, ensuring its peg in addition to the Bitcoin reserve fund Terra has been building. Kwon has stated that his objective is to starve the 3pool, and if he succeeds, that could undermine DAI’s stability and make it less attractive to high-net-worth traders.MakerDAO controls DAI and therefore has virtually no influence over Curve rewards distribution, as it holds almost no Curve rewards in its treasury.

The MakerDAO team may need to acquire large amounts of CRV in the so-called “Curve Wars,” or alternatively arbitrage liquidity on other decentralized exchanges such as Uniswap and Sushi in return for its governance token MKR in order to futureproof and secure DAI liquidity in the long term.

The fact remains that Terra has forced MakerDAO onto the defensive. In the face of changing market conditions, DeFi’s once-largest asset must now reinvent itself to survive and remain relevant. While DAI was one of the first decentralized stablecoins to hit the market in December 2017, it has been overtaken by UST over the past year.

UST’s market capitalization is roughly $16.8 billion, almost double DAI’s $9 billion market cap, and this is before 4pool launches.

Via this site.