The curve rallies by 54%, and is expected to remain on a winning streak. DeFi Protocol has seen tremendous growth in the last few months.

The DeFi protocol has achieved top position today, having grown from some thousand dollars in total value locked (TVL) when it was launched in February 2020. The protocol still has certain issues to deal with, however, and the Curve community has asked for a new type of committee.

The Protocol Review Committee Provides Insight On Curve

Curve has become the world’s largest DeFi asset at the moment with $20 billion in TVL, surpassing MakerDao, AAVE, and others with consistent price increases over the past month.

Due to the incident in Mochi, the Emergency DAO decided to kill the USDM gauge last week. This prompted many members of the Curve community to request a review committee analyze the protocol beforehand.

For the same reason, a proposal was made to establish a Gauge Risk Assessment Team that would be tasked with reviewing and documenting any risks related to any protocols being applied for a gauge.

Curve Dao tokens have gone up 54% in just 3 days after the proposal was made following community support for the offer. Also, the average price of CRV has increased from $4.94 at the start of the week to $5.8 as of today.

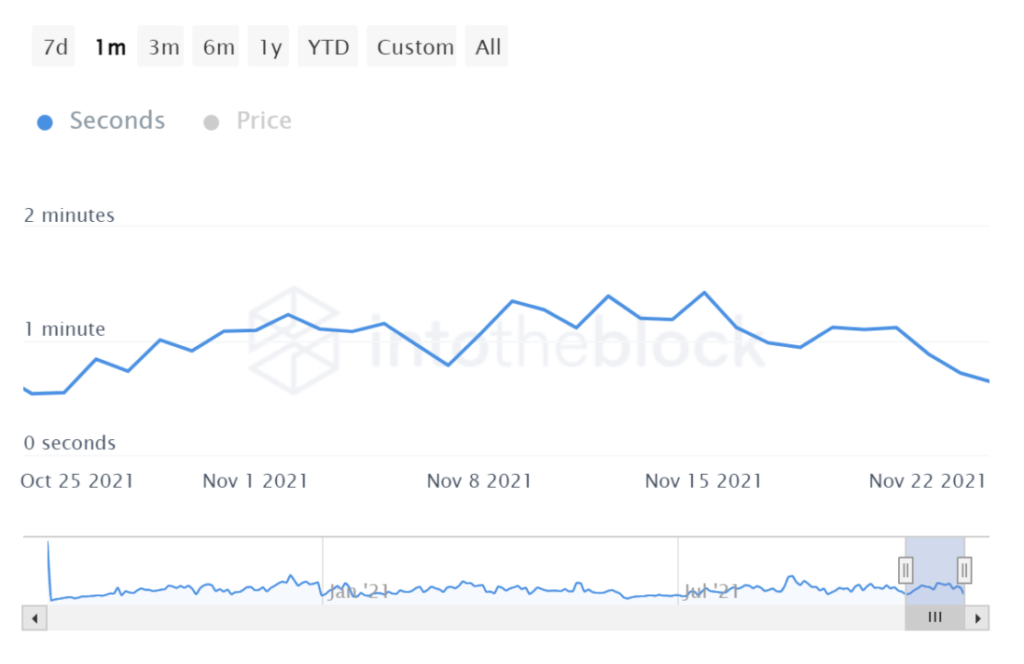

Furthermore, the number of active addresses on the network doubled within a week to 1.8k users, and the average number of transactions on the network increased by 4 times from $60 million to 38 seconds. The time between transactions also decreased from one minute to 38 seconds as activity increased.

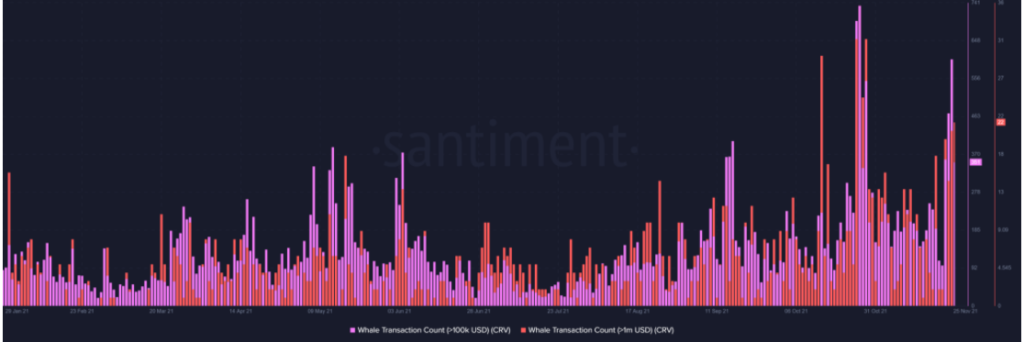

Retail investors weren’t the only ones to move their CRV this week; whales didn’t shy away from it either, increasing their volumes to $230 million. However, it’s not that alarming given that 85% of all holders on the network are whales.

CRV holds 92% of all 428 million addresses, so these 11 whales are very crucial to keeping price movement stable. Moving forward, CRV will hold its crown as the largest DeFi protocol as long as it keeps up its stability.

Via this site.