DAI is new, but it’s already making waves. Here’s what you need to know. – DAI is a new cryptocurrency designed to facilitate the obtaining of loans – Its price history is pretty stable, but it’s predicted to rise in the coming years

Lots of questions surrounding DAI. Let’s take a closer look at its price history, as well as what people are making as a DAI price prediction for 2021 and beyond.

What is the DAI price prediction? As a stablecoin designed to facilitate obtaining loans, is DAI a good investment?

A lot of people are talking about DAI lately. What’s its future? Let’s look at its price history, as well as what people are making as a DAI price prediction for 2022 and beyond.

MakerDao Stablecoin Project DAI

MakerDAO has two native tokens: DAI and MKR. MKR is a governance token, much like a lot of other cryptocurrencies. Those holding MKR can vote on proposals about changes to the network. The more MKR you own, the more power you have. Also, MKR works as an investment in MakerDAO. It is possible to loan out MKR by generating interest from those loans. The interest is used to buy more MKR and then burn the tokens. DAI is different because it is not conventional cryptocurrency that can be, theoretically, incredibly volatile. Burning tokens creates scarcity, which should, theoretically, keep the price of MKR sustainable.

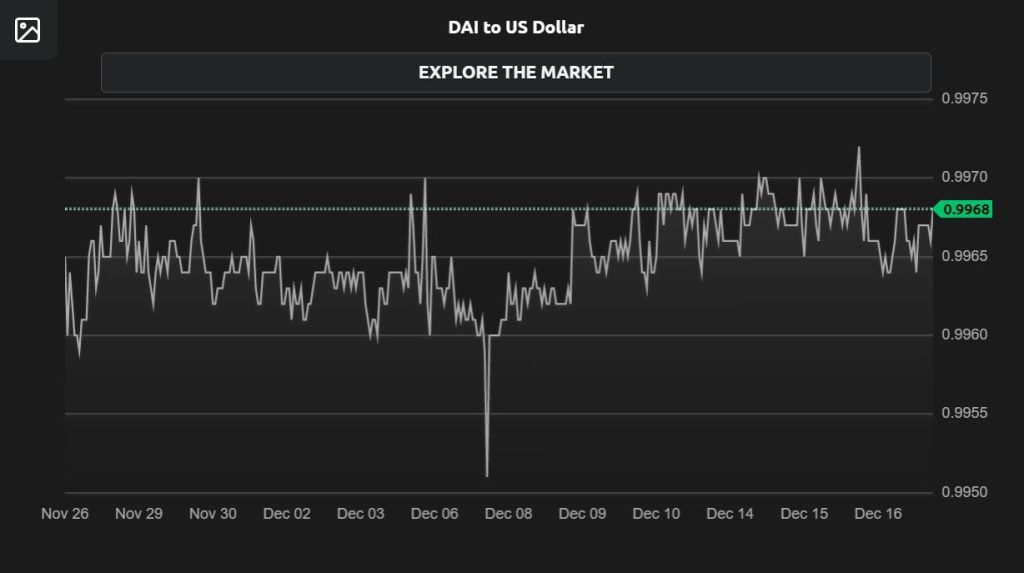

Stablecoins are backed by a fiat currency, such as the US dollar. DAI’s price is pegged to the dollar, so ideally, the price should stay flat, close to or even at $1. As we will see later, DAI’s value isn’t very volatile, at least in comparison to other non-stable cryptos. This deserves consideration when predicting DAI’s price.

MakerDAO was founded in 2014 by Danish entrepreneur Rune Christensen. The DAO is a digital autonomous organization. It is a program, almost always based on the Ethereum blockchain, with a built-in ability to help individuals manage their code.Cryptocurrency is used in decentralised finance (DeFi), which bypasses traditional financial institutions to make financial transactions. DeFi is ultimately responsible for cryptocurrency’s success. According to the World Bank, approximately 1.7 billion people do not have bank accounts, and this method allows them to transfer money internationally without having to pay commissions or remittance fees. The MakerDAO platform was created to allow people to take out loans using cryptocurrency as collateral. The loans themselves are actually made with DAI.

Because MakerDAO backs the DAI coin itself, DAI is different from a lot of stablecoins, which are backed by a private company. Despite not being publicly owned, MakerDAO is decentralized – each of the MKR token holders makes decisions and no single person is in control of the project.

MakerDAO has set up a series of smart contracts to ensure the price of DAI stays close to the value of the dollar. Smart contracts are computer programs that execute automatically once certain conditions are met. In this case, the smart contract executes to make sure the value of the DAI crypto does not fall or rise too high. In addition, it’s important to note that DAI, which is used in loans, does generate interest, so holders of the coin can also generate profits from it.

Via this site.