MakerDAO is one of the major players in the crypto space currently minting the most popular DStablecoin, DAI, which is pegged to the US dollar, backed by a variety of crypto assets. A MakerDAO spokesperson said that it’s “likely” that MakerDao will “move into DeFi space” and offer more stablecoins. This will be a big deal for Defi.

For those who don’t know, MakerDAO is a Decentralized Autonomous Organization on the Ethereum blockchain. MakerDAO has been minting this popular decentralized stablecoin since December 2017 and it currently supports a variety of crypto assets.

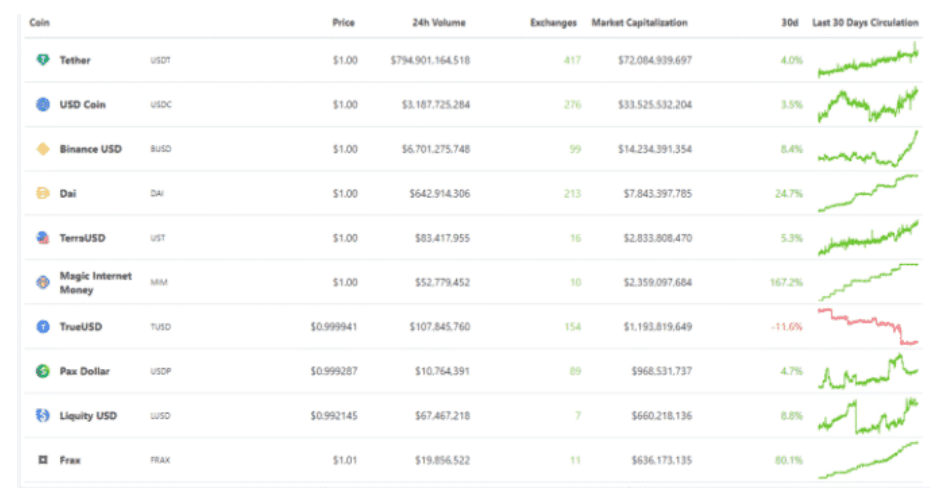

As opposed to its more well-known counterparts such as USDC and Tether’s USDT, DAI cannot be blacklisted, shut down, or censored, and it comes from the same source as Bitcoin and Ethereum. In terms of market capitalization, Dai is the fourth largest stablecoin with an $8 billion market cap, while USDC is the third biggest stablecoin and Tether ranks third.

Making almost collapsed during the Black Thursday event in March 2020, when the entire market crashed.

Following a cascade of liquidations on Maker, the protocol was pushed to the brink with DAI losing its dollar peg. Almost always, liquidations are a risk with volatile assets backing stable assets, even if the backing is over-collateralized. In addition to an emergency debt auction that sold new coins for DAI and adjusted the system parameters to prevent the liquidation cascade from occurring again, USDC was also added as collateral.

The last change to Maker, adding USDC as collateral, was highly controversial, because it raised two important questions: how decentralized DAI is and is it backed by a centralized currency; and why don’t DAI users simply purchase USDC. The problem was even worse after USDC was added as a collateral asset, with the centralized stablecoin becoming the most important collateral or 50% greater than all collateral backing DAI. There were many decentralized stablecoins created after this fiasco and most of them failed to meet even DAI’s standards.

The Latest Data From Dai Stats

Many of the questions surrounding DAI’s degree of decentralization were answered this week, and new data from DAI stats indicates that Ethereum is the most important collateral asset for the decentralized stablecoin.

Furthermore, this means if we encounter another huge crash like Black Thursday, Ethereum will be in for a bumpy ride despite the fact that many people support it. However, it does not make Ethereum as risk tolerant as USDC.

In October, Rune Christensen, as the project’s founder, announced the return of ETH to DAI, noting that the market capitalization of the project had increased by 1.4 billion before staked ETH and direct deposit modules were available.

Via this site.