The defi protocols are evolving. Both MakerDao’s DAI and Olympus DAO’s OHM protocol are new approaches to stablecoins, backed by different assets. Check out the differences below and the links to the websites for more info.

Bitcoin.com News reported in mid-October that algorithmic stablecoins or decentralized finance (DEFI) have seen significant growth in 2021. Stablecoins such as Olympus DAO’s OHM are quite different from the traditional reserve currency defi protocols in that they are free-floating currencies backed only by their reserves in the Olympus DAO Treasury.

Even though OHM does not have a U.S. dollar backing, it still ranks fifth in terms of market capitalization as a crypto reserve currency with a market cap of $3.6 billion.

Decentralized Finance (defi) and Algorithmic Stablecoins – Taking The World by Storm

At the start of stablecoin, there was a centralized model that used blockchains to distribute tokens with fiat backing from third-party custodians.

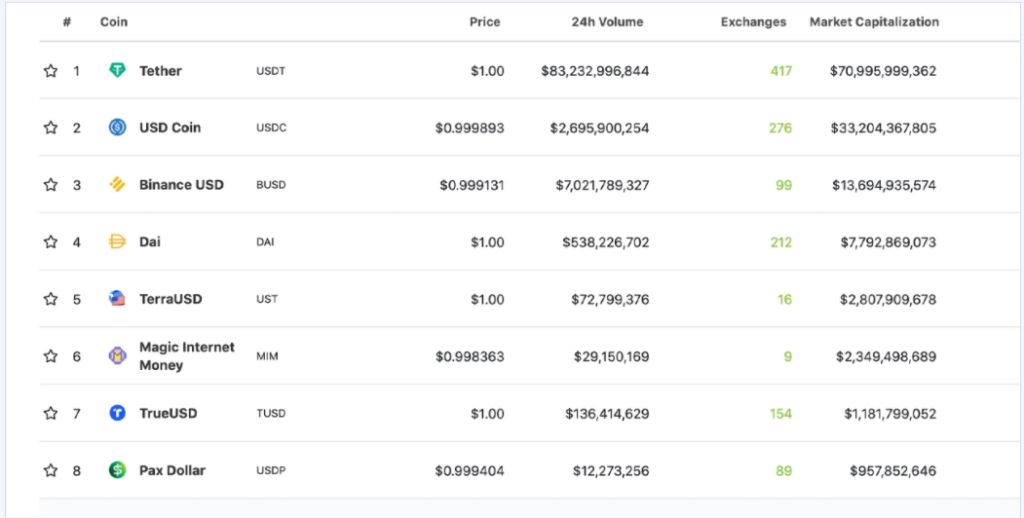

Decentralized finance (defi) or algorithmic stablecoins such as Makerdao’s DAI have emerged as alternatives to the centralized model. Today, the top two stablecoins by market capitalization are USDT and USDC, both excellent examples.

More than just a store of value, stablecoins are proving to be the most important innovation in finance in decades. And when it comes to stablecoins, MakerDAO is leading the pack.

The MakerDao Platform –

Makerdao is a decentralized autonomous organization (DAO) based on Ethereum which issues DAI, a stablecoin backed by overcollateralized loans and Makerdao’s repayment scheme. A DAO consists of smart contracts encoded in a framework, and network participants control the organization’s goals.Without an intermediary, Makerdao facilitates loans and issues a token pegged to the U.S. dollar.

A great number of decentralized stablecoins have joined the crypto economy since Makerdao’s DAI stablecoin became successful. A number of these blockchain assets are backed by fiat currency, like the United States dollar, according to Coingecko’s “Top Stablecoins by Market Capitalization” list.

A project by the name of Olympus DAO has developed a very different reserve currency protocol that issues the OHM token. Olympus Treasury holds its crypto assets rather than U.S. dollars, as with USDC and DAI.

The Olympus Dao Protocol

In a post on February 1, 2021, the Olympus DAO team explained how this project is different because it’s a free-floating currency backed by the Treasury. The Olympus DAO introduction explains that OHM tokens are backed by 1 DAI in the treasury, but that tokens cannot be minted or burned by anyone but the protocol.

In response to price, the protocol buys back and burns OHM when it trades below 1 DAI; when it trades above 1 DAI, it mints and sells new OHM.” The project’s introduction blog post states:

It either makes more than 1 DAI on a sale or spends less than 1 DAI on purchase every time it buys or sells, since the Treasury must hold 1 DAI and only 1 DAI for each OHM. Having DAI for each token in the protocol allows us to say with certainty that OHM will not trade below its intrinsic value over the long run, allowing defined risks to be applied to investments.

OHM’s first recorded value on May 23, 2021, was around $162.79 per OHM. The project’s governance model allows participants to participate in stakeholding, as well as leverage a bonding strategy. Today, one OHM is worth $1,057 per unit, an increase of over 540% since then.

OHM is a cryptocurrency with a market capitalization of around $3.6 billion and has grown 120% in the last 30 days. There is $126 million in global OHM trading volume and 3,517,713 OHM in circulation at the time of writing.

Olympus DAO and Smart Contract Vulnerabilities, Price Crashes and Legal Issues

Others have called the project a pyramid or Ponzi scheme, despite the fact that many proponents say people shouldn’t dismiss OHM and the Olympus DAO. While others have expressed concerns about OHM’s volatility, price stability is not the ultimate goal of this stablecoin backed by treasury assets.

On the Okex Academy blog, an article discussing Olympus DAO discusses potential risks like smart contract vulnerabilities, price crashes, and regulatory issues with governments.

OHM/DAI chart on November 1, 2021, via Tradingview.

Stablecoins currently have a value of $137 billion and most transactions within the crypto economy are settled in digitized dollars. In Zeus’ opinion, the trend is contrary to the main goal of the crypto revolution – to compete with and eventually replace fiat currencies.

The USD Value of Functional Stablecoins May Remain Stable

Zeus said this July that it is strange irony that the most popular cryptocurrency is simply a digitized dollar.Although stablecoins achieve a stable value in USD, that doesn’t mean their purchasing power will remain the same. Their real value fluctuates just like dollars in a bank account.

Via this site.