The crypto derivatives market is a trillion-dollar industry that has grown substantially over the past several years. Even though crypto derivatives have existed for some time, their trading volume is still relatively low. For this reason, many crypto derivatives trading platforms have sprung up to offer their users with a wide variety of derivative products. However, recent regulatory actions have made it more difficult for centralized derivatives exchanges to operate.

DYdX said that it is considering full decentralization so its users can take advantage of the advantages of DeFi.

DYdX, an Ethereum Layer 2-based crypto derivatives trading platform, has pledged to become “100% decentralized by EOY” with the V4 update to the protocol.In particular, dYdX offers perpetual contracts, which combine elements of spot margin trading and futures trading without having an expiration date.

dYdX is currently only decentralized in its Ethereum smart contracts, governance, and staking. dYdX Trading Inc., the company that created the platform, manages the platform’s “orderbook” and matching engine. Yesterday, dYdX announced the V4 update on Twitter, stating: “You are not yet ready.”

TwitterAccording to dYdX’s blog post, the “primary aspect” of fully decentralizing the platform involves the orderbook and its matching engine. According to the team, the biggest challenges will be scaling throughput (transaction processing power), finality (off-chain trade matching), and fairness (operators will not be able to extract value from legitimate trading activity) in a decentralized manner.V4 will fully decentralize dYdX.

All aspects of the protocol that can be controlled by the community will be able to be controlled,” the roadmap reads. DYdX outlined the “fundamental improvement” that decentralized finance (DeFi) provides over centralized financial services in explaining why the platform is going fully decentralized:

“DeFi offers a massive improvement in transparency. For the first time, the financial system itself is no longer a black box to users. With DeFi, users can trust code instead of corporations.”

In the V4 update, dYdX Trading Inc. will receive zero trading fees moving forward and the platform will offer more products and services, including synthetics and spot and margin trading.

DeFi projects often claim to be “decentralized” since they implement smart contracts and have automated setups, but they are often controlled by a small core team with ‘god mode’ powers over the protocol. This is often a useful strategy to recover from errors when building the platform, but introduces centralized risks.

During an interview with the U.S. Securities and Exchange Commission in August last year, Gary Gensler argued that DeFi is largely centralized, citing:

“These so-called ‘decentralized finance’ platforms actually have a lot of centralization. There’s a group of entrepreneurs that are running these platforms.”

One of the DeFi projects to announce full decentralization, or being “fully self-sufficient,” was MakerDAO, creator of the DAI stablecoin and pioneering protocol.

According to Rune Christensen, CEO of the Maker Foundation, “the protocol and DAO will be determined by thousands or perhaps millions of enthusiastic community members.”

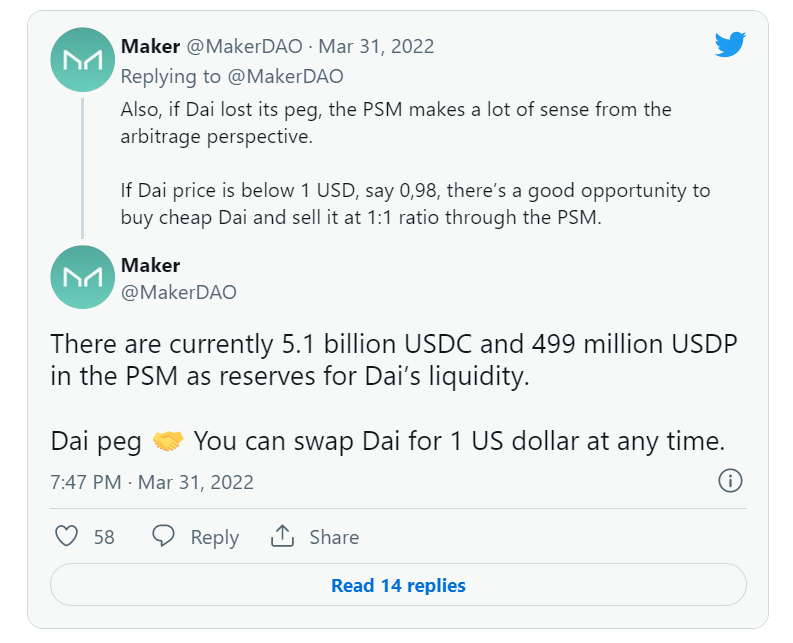

However, critics point out that MakerDAO has 5.1 billion USDC stablecoins backing its DAI reserves, so it’s hard to determine how much decentralization it really possesses.

Image