There has been a lot of chatter in the crypto world about stablecoins. The concept is that stablecoins are a type of digital currency that is pegged to a fiat currency, such as the US dollar. They are designed to minimize volatility and produce a market price that is always equal to or greater than the value of its pegged currency. However, according to on-chain data, this is not the case.

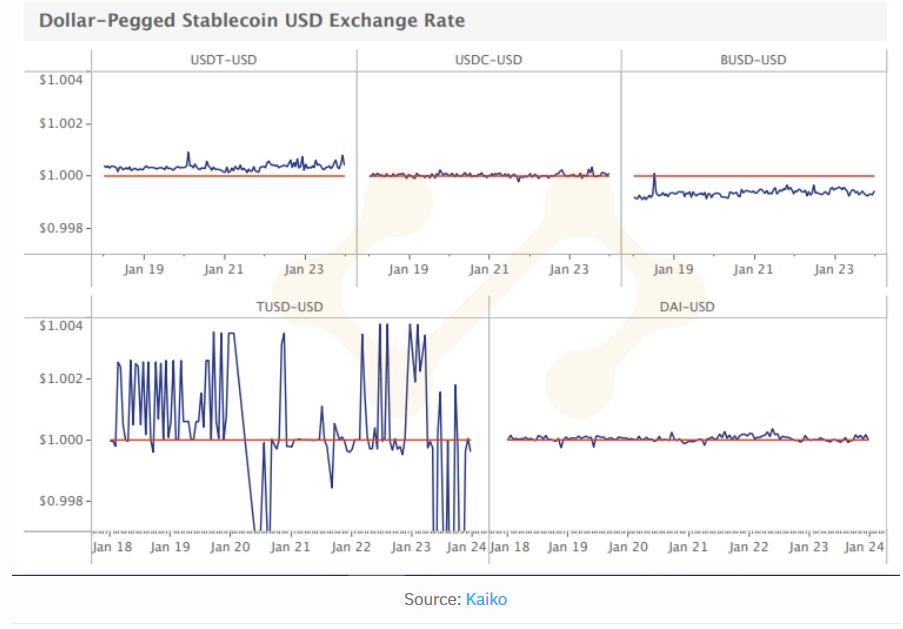

During the recent market capitulation, stablecoins experienced increased volatility as investors flocked to them. During the market crash, stablecoins underwent increased volatility and traded above or below their pegs.

During the current market downturn, crypto investors converted their holdings to protect themselves. Stablecoins’ market capitalization is over $174 billion, and their trading volume is over $96 billion, according to Coingecko.

Kaiko Report: A Closer Look At The Different Types Of Stablecoins

Taking a closer look at the Kaiko report, all stablecoins on the market experienced some level of volatility. Some of the pegged currencies experienced a greater inflow of capital than the others and were unable to hold on to the peg.

It was DAI, the stablecoin regulated by MakerDao, which maintained the closest peg with the US dollar (USD). It was also closely watched by the USD Coin (USDC) managed by the Center consortium, which increased its reserves recently to ensure transparency.

True USD (TUSD), with 53% of stablecoin market share, traded below its peg. The Binance USD (BUSD), which held 53% of the stablecoin market share, saw dramatic price swings.

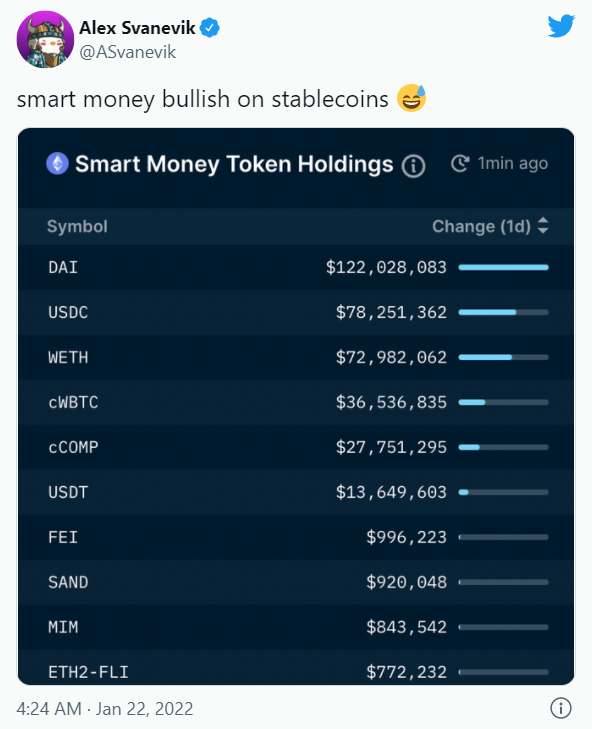

Throughout times of market decline, stablecoins have continued to provide investors with a safety net. It is evident from the general sentiment across social media that traders have quickly moved from volatile assets to dollar-pegged cryptocurrencies.

Tether’s Collapse: The Fallout Of A $40 Million Fine!

Stablecoins have risen to the forefront of regulatory discussion due to their increased adoption worldwide, as well as doubts over the USD’s collateralization of these digital assets. A $40 million fine was levied against Tether by the Commodity Futures Trading Commission (CFTC) for false claims regarding its USD backing.

Among the major targets were Circle and Tether, with the former increasing its cash reserve as stated earlier. The US financial institution Paxos called stablecoin providers unregulated and opaque in their operations. The reserve of Tether at the time of Paxos’ claim was 2.9% cash, that of USDC was 61% cash equivalent, and that of PAX and BUSD were 96% cash.

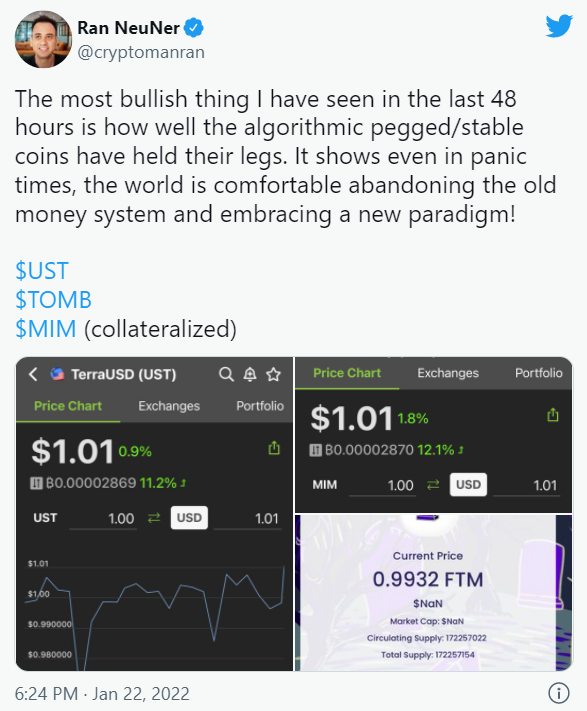

Stablecoins backed by USD face a transparency challenge, which has led to algorithmic solutions. The TerraUSD (UST) and Dai digital assets are supported by cryptocurrency collateralization. Their innovative approach to pegging has seen tremendous adoption.

Terra’s native cryptocurrency, LUNA, is burned if its value exceeds the USD peg in a one-of-a-kind pegging system. MakerDAO smart contracts maintain the USD peg for DAI, as well as backing it with ETH and USDC.

Experts and investors alike have praised these algorithmic stablecoins for holding their value during the recent selloff. Co-founder, and CEO of Onchain Capital, Neuner claimed that the world had embraced a new monetary paradigm and has been elated with their performance.

Why Stablecoins are the Future

Reports indicate that the US government will be releasing an executive order in the coming months regarding cryptocurrencies. Central bank digital currencies (CBDCs) will be one of the components of the directive.

Concerns have been raised regarding the possibility of stablecoins and CBDCs coexisting. The direction that stablecoins take will be heavily determined by the directive given.

While stablecoins are growing in popularity, the increased transparency and innovation within them augur well. As more investors become interested in stablecoins, this financial tool may prosper even further in the future.

Via this site.