Investors have taken a keen interest in stablecoins — digital currencies designed to avoid the volatility common in other digital tokens. If bitcoin is the wild west of digital assets, then stablecoins are the settlers who arrive bearing cheques and scripture. The problem is that most stablecoins have failed to keep their values pegged at $1.

Investors searched for a truly “stable” dollar pegged asset after Terra’s collapse forced them to abandon Terra’s UST

Cryptocurrency prices have taken a beating over the past few weeks. There has been a steep decline in Bitcoin (BTC) prices, multiple stablecoins have lost their pegs, and demise of one of the largest decentralized finance (DeFi) platforms has resulted in $900 billion being removed from the cryptocurrency market capitalization.

MakerDAO (MKR) managed to turn the widespread fallout into an opportunity, and the collapse of TerraUSD (UST) has given renewed attention to DAI, the longest-running decentralized stablecoin.

MKR climbed 66.2% from a low of $952 on May 12 to its current value of $1,587 as the collapse of Earth (MOON) price intensified.

There are three possible explanations for the MKR’s reversal: DAI’s decision to maintain its peg during the recent market turmoil, the use of a MakerDAO vault to finance supply chain shipments and the addition of staked Ether (ETH) as collateral to mint COME ON.

Despite strong market turbulence, the DAI remains steady

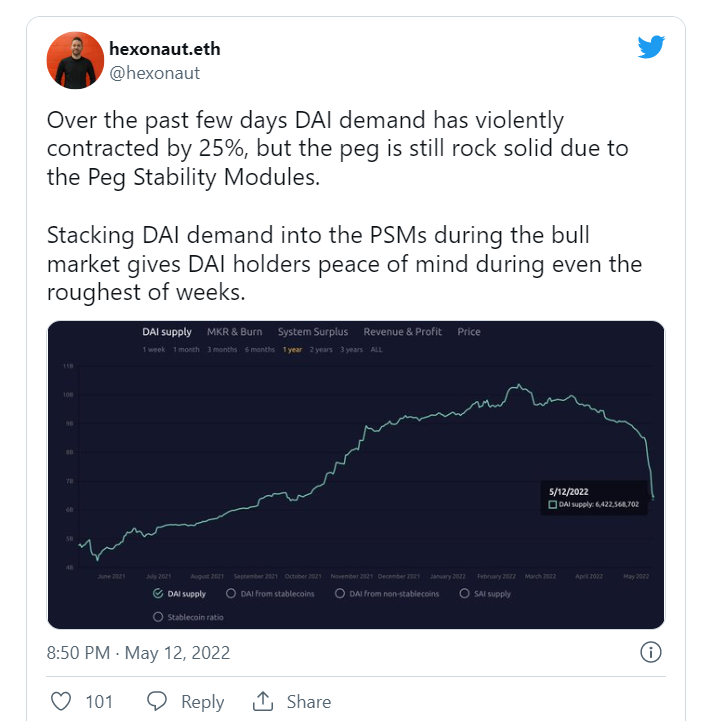

One of the most important factors contributing to investor confidence in the MakerDAO ecosystem is the fact that DAI held its dollar peg during a shaky market when many of the most popular stablecoins lost their dollar pegs.

The price of DAI oscillated from a low of $0.9961 on May 11 to a high of $1.0046 on May 12, and is now trading at $0.9994.

Even after Tether (USDT) briefly hit a low of $0.9704, holding steady for more than 2.2 billion DAI may have given investors more confidence.

MKR Growing Adoption

The growing adoption of MKR in the real world is another factor contributing to its growth. An Australian beef shipment was recently financed using the MakerDAO vault, and other “use cases” are in development.

The trade finance service provider ConsolFreight used a MakerDAO vault in conjunction with Centrifuge on May 9 to mint DAI that was used to finance the transaction.

During the process, a nonfungible token (NFT) containing shipment and invoice data was also minted to help track the transaction. Provenance, a blockchain-based traceability solution from Mastercard, is also being used to track the shipment.

Supply chain applications of smart contracts and stablecoins were demonstrated through this transaction.

Staked Ether as Collateral

MakerDAO has also gained momentum since the protocol now supports staked Ether as a form of collateral.

In sETH2, participants can access funds that would otherwise be locked up for an unknown amount of time and use them to earn DeFi yields.

According to data from Defi Llama, MakerDAO is ranked as the top-ranked DeFi protocol by total value locked (TVL) following the collapse of UST and its knock-on effects.

MakerDAO took top spot shortly after Curve’s TVL fell from $19.32 billion on May 5 to $8.71 billion on May 16, another stablecoin liquidity protocol.

Via this site.