The collapse of stablecoin project Terra last week left questions and concerns regarding the future of stablecoins, with many pointing to a lack of due diligence and regulatory oversight as the main cause. Rune Christensen, CEO at MakerDAO, explains why he believes that it was “long overdue” for Terra to collapse and calls for rules on stablecoins.

Christensen: “Greed allows people to pretend that one plus one equals two.”

Rune Christensen, CEO cofounder of MakerDao, and a longtime critic of TerraUSD, was vindicated in the collapse of TerraUSD by the collapse of its model.

In TerraUSD, the value of the coin is pegged at $1. To defend that peg, TerraUSD users could always exchange 1 TerraUSD USTUSD, 6.18% for one unit of a cryptocurrency associated with TerraUSD, LUNA. Aside from the collective confidence of its holders, there was no guarantee of LUNA’s LUNAUSD, -5.56% value. That confidence vanished in quick order earlier this month.

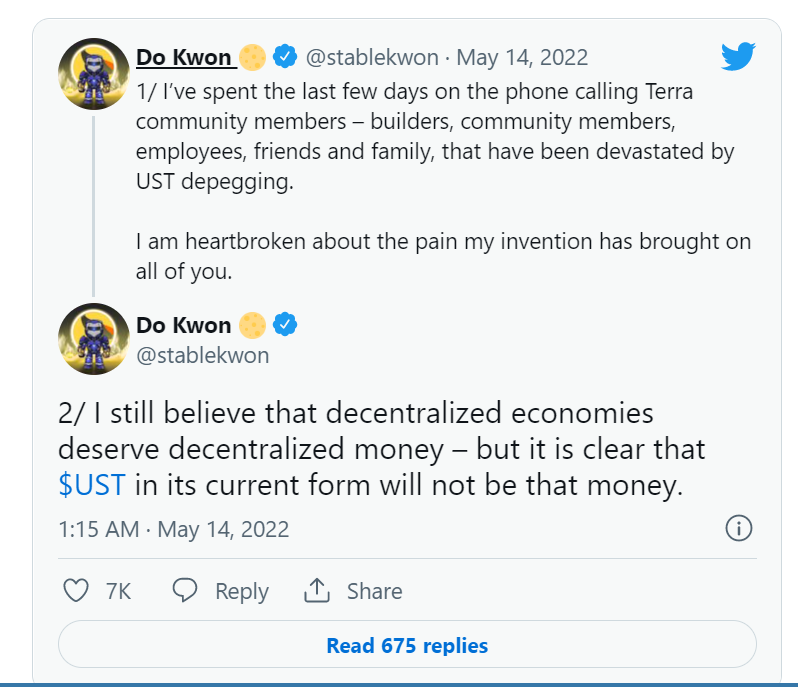

According to Do Kwon, Terra’s founder, he was “heartbroken” by the crash last week.

Kwon announced on Twitter his plan to “rebirth the Terra blockchain and LUNA” on Wednesday.

MakerDao, a stablecoin asset backed by a wide variety of crypto assets, is built on the ethereum ETHUSD, -1.32% blockchain. Overcollateralized means users have to post more than one crypto asset to get back one Dai DAIUSD, -0.03%.

Christensen spoke with MarketWatch via video conference Thursday to discuss the crypto landscape following the Terra drama and broader decline in crypto. This is an edited version of the original interview.

The Collapse of Terra

The algorithmic stablecoin model that Luna and Terra used was invented all the way back in 2014. The idea was more or less a theoretical one, and everyone could tell just by looking at it that it wasn’t going to work.

This type of stablecoin started popping up during the bull market we just experienced. Terra somehow managed to gain more legitimacy and momentum and actually grow to this massive size.

The models still didn’t work, but that was obvious. There was no doubt about it. Money cannot be created from thin air. One cannot back something with itself and expect it to remain stable.

It had been overdue for collapse, and it was a tragedy that it was allowed to grow so big, largely due to its many major backers.

How do you explain the appeal of this model to sophisticated investors?

Those who are greedy can pretend that 1 plus 1 isn’t equal to 2. Those who are greedy can imagine printing free money.

Probably they thought it had a chance of working. Also, there are some hard-core public figures who have backed Luna and gained credibility by losing everything. As a result, some of them truly believed it worked and clung on to the very end, losing everything along the way.

Some people might have also understood that it was basically a ride you only want to take on the way up.

There is a lot of debate about whether Dai can truly be called decentralized. Terra was appealing because it was decentralized. How do you feel about this topic?

As part of its collateral, Dai utilizes USDC USDCUSD, 0.00%, a centralized stablecoin, which has been attacked by the Luna community.

It is because the original model, which only used ethereum, used these overcollateralized positions, which ensure there will always be more ethereum than Dai in circulation. It is difficult to control the amount of interest in the price of ethereum.

Dai could only be scaled by adding something you can easily scale, so that every time somebody wants more Dai, it can be backed by USDC one-to-one.

It isn’t ideal to have high exposure to just one, centralized stablecoin from a point of failure and decentralization perspective. In contrast, it’s better than collapsing to zero. Due to the limited choices available at the time, especially when ether supply began to exceed demand, this was a sensible choice.

Dai users are always at risk and it’s just a matter of protecting them. In the end, holders of the MKR token, MKRUSD, -5.34%, which confers voting rights, have an incentive to backstop any losses experienced by users of Dai.

There is no question that you do not want to have all of your collateral in a single token, whether centralized or otherwise. Therefore, the community is working very hard to diversify out of USDC into other coins such as USDP, Paxos USD, and Gemini USD.

What is the value of this argument over centralization?

There are different levels of centralization. Depending on the blockchain, some may have hundreds of thousands of nodes, while others may have fewer than a hundred. All are decentralized, regardless of their level of decentralization.

Decentralization isn’t the only thing you need to consider. You also need to consider the risks. As Terra illustrates, centralization is not the only thing to worry about.

Stability, usefulness, and relevance are just a few of the many factors to consider.

The Future of DeFi

Due to blockchain experiencing two major bubbles, one in 2017 and the recent bubble and crash, I think we’ve passed the honeymoon phase where people thought something amazing would be around the corner that would solve all of finance’s problems.

Major financial institutions and banks are seeking to put real financial instruments on the blockchain to make financial transactions more efficient and cheaper.

The French company Societe Generale, for example, is creating tokenized assets on MakerDAO. We will see what kind of benefits this provides.

Via this site.