It’s time for the great DAO test to begin. New governance proposals outlined a number of changes, including the formation of a Growth Task Force and an Oversight Core Unit that would have been responsible for checking every financial decision made by the organization. However, this latest iteration received a negative response from token holders.

An organization based on democratic decision-making was always going to face challenges. A company operates best when its senior management team and CEO exercise clear, hierarchical control.

Decentralized autonomous organizations, such as MakerDAO, are searching for a way to balance business efficiency with egalitarian values.

Frustrating and complicated

There is a good chance that it will show the way for the rest of the DAO community. It is going to be complicated and fraught if the actions this week are any indication.

Sam MacPherson, the author of a proposal that would have created a “Growth Task Force” at MakerDAO and a member of the Protocol Engineering Core Unit, tweeted, “The status quo is not working.” Decision paralysis or suboptimal decisions are occurring at MakerDAO due to a lack of high-level decision making.

During its meeting on June 27, MakerDAO’s membership considered three proposals that would have restructured its management approach in profound ways, possibly leading to the creation of a quasi-board. The DAO’s members rejected all three proposals, which would have created three seven-figure budget working groups.

Nevertheless, their introduction for a vote marks a pivotal moment in DAO evolution. According to GFX Labs, which develops protocols as well as writes governance proposals across DeFi, the proposal to establish a “core unit” to oversee collateral asset onboarding is groundbreaking.

A controversial governance vote for MakerDAO… perhaps for all DAOs, has just been completed, according to GFX Labs.

A drama about governance

As the DeFi community undergoes a period of soul-searching during the worst bear market since 2018, the governance drama comes at a particularly challenging time. DeFi lending space is under stress following Terra’s failure in May. A court ordered Three Arrows Capital, a $10 billion hedge fund, to liquidate on June 29.

MakerDAO has held steady in the midst of the volatility. Maker’s flagship stablecoin, DAI, has held its peg to the U.S. dollar despite other stablecoins oscillating.

Maker has completed deals allowing real world assets to be collateralized, bridging DeFi and traditional business and finance. MKR has dropped 36% in the last 30 days – dismayed, yes, but better than Ether’s decline of 47%.

It is also important to note that MakerDAO has been completely decentralized since July 2021.

Deals in the real world

Herein lies the problem: How can DAOs preserve decentralization while generating the growth they need to truly transform finance? MakerDAO’s co-founder, Rune Christensen, has clearly been thinking about this question.

In a major post on May 30, Christensen wrote, “Governance processes and political dynamics are fundamentally incompatible with processing complicated real-world financial deals.”

A prominent truth-teller in the DAO community, Christensen denounced MakerDAO’s loss of financial capital and apathy among its members.

There’s no longer a feeling of indifference among members.

This week, three proposals were floated that would have reshaped MakerDAO.

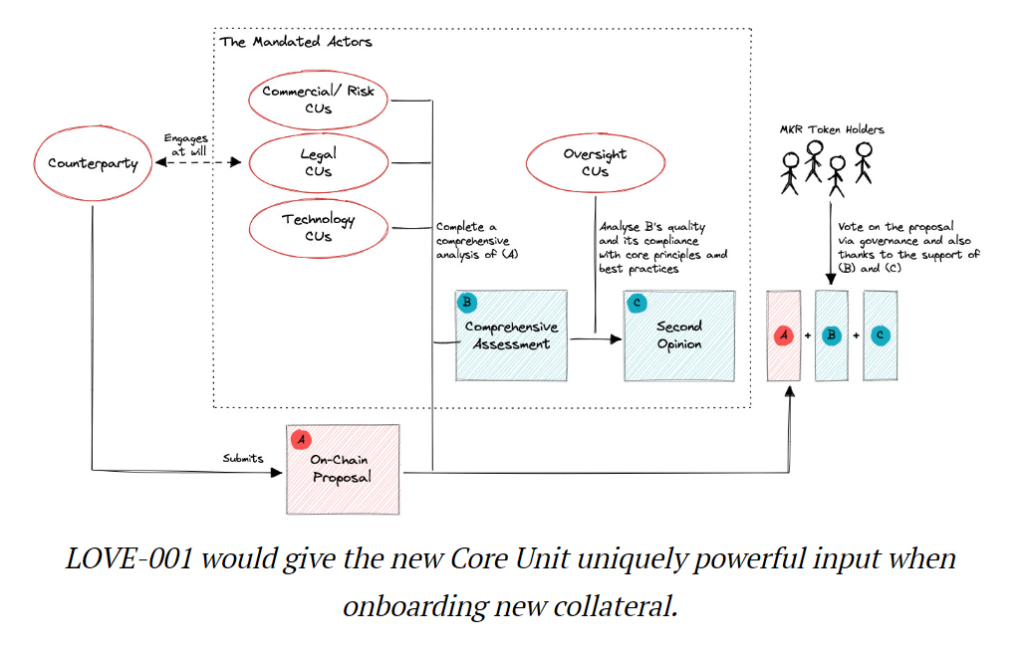

Love-001 proposed the creation of a new Core Unit. Its mission was to “enforce MakerDAO’s role as the central pillar of the DeFi monetary ecosystem by supporting the onboarding of tens of billions [of dollars] worth of complex assets and ensuring the alignment of those activities with a sustainable and decentralised risk framework,” according to the proposal’s forum post.

There was one feature that stood out in the proposal: the Core Unit would “periodically audit other Core Units’ activity.”

Oversight Core Unit

Indeed, LOVE-001 calls itself an “oversight Core Unit” and a diagram in the proposal positions the Core Unit as having a special position as the second opinion on analysis of new collateral types. More than 60% of 293, 911 MKR votes went against LOVE-001.

DeFi researcher Hasu, who voted “yes” on LOVE-001 and the other proposals, is pushing for Maker on Twitter to have a DAO style board of directors.

According to the explanatory document, the second proposal, named Makershire Hathaway, would test earning yield by using $10M of the protocol’s $5.4B in stablecoins. Makershire Hathaway received a thumbs down from 65.8% of the 207,087 MKR tokens voted.

The third, MIP75c3-SP1, would essentially establish a discretionary fund under the control of what the proposal calls a “Growth Task Force.” It would be made of nine members from a handful of Core Units.

‘As Fast as Possible’

With 76.3% of 230,000 MKR tokens voting against it, the Growth Task Force proposal lost by the widest margin.

A primary objective of the Task Force would be to grow Maker “as quickly as possible,” according to its mandate. Initially, a $1M budget would be allocated for conference sponsorships, an offsite for the entire DAO, and hiring a lawyer to review possible capital raise structures.”

Maker’s constituents believe it is a crucial time for what is arguably DeFi’s most advanced and decentralized governance system because of the record turnout and efforts to scale the DAO.

Voting Blocs

A sizable budget accompanied with the power to make autonomous decisions are the objectives, according to Wouter Kampmann, co-founder of the Sustainable Ecosystem Scaling (SES) Maker Core Unit. Within Maker, Core Units serve as departments.

By using the MKR token, users can either vote themselves or delegate their votes. Maker’s co-founder Rune Christensen, for example, delegated 78,626 MKR to 10 different voting delegates. On June 27, Christensen delegated 3,000 MKR to researcher Chris Blec as a last-minute change in his delegations.

In order to increase efficiency, the DAO could either centralize or slow down and develop more efficient governance processes.

The SES Core Unit is developing a dashboard to communicate more clearly what initiatives each Core Unit is tasked with, their respective budgets, and other relevant data.

Decentralized Project

Even though the votes did not result in immediate changes to MakerDAO’s governance, they galvanized the members fundamentally. All eyes in the community will be watching closely to see what happens as this storied organization grapples with the challenges of the DAO structure and mission.

As a result of yesterday’s vote, MKR has rallied enough to demonstrate beyond any doubt that Maker is no longer controlled by a single party. Neither theoretically nor practically,” Kampmann said. Historically, the project has gradually decentralized.”

Via this site.