Central Banks and Regulators don’t want competition when it comes to issuing new dollars. Which is why they’re watching stablecoins like a hawk. Stablecoins have been growing since early 2018 and that’s something that’s really starting to worry the big players. Yet, the trust in these coins is low since Tether was revealed to not be backed by real USD and has been accused of being part of manipulating and pumping bitcoin prices.

That’s why they’re starting to take action like forming an alliance, and launching their own stablecoin. Don’t miss out on the opportunity to be a part of the revolution!

The basic function of these coins is to offer a digital alternative to fiat currency. They’re backed by the value of the underlying fiat currency, which is usually dollars.

A lot of things are up for debate when it comes to stablecoins and how some of the most popular ones are acting, but we will ignore that. This article is about how stablecoins have grown and if there have been any significant changes. The basic function of these tokens is to keep a peg to a fiat currency, in most cases the USD.

Usually, a bank deposit equal to the amount of each token minted is required as fiat collateral for the token. Tokens like DAI are typically backed by crypto collateral that is overcollateralized.

The UST and HBD tokens can be converted to one dollar’s worth of their main crypto pair, LUNA and HIVE.

Here we will be looking at:

- Tether [USDT]

- USD Coin [USDC]

- Binance USD [BUSD]

- Dai [DAI]

- Terra-UST

- PAX

- Huobi USD [HUSD]

Tether [USDT]

Tether is the oldest stablecoin in cryptocurrency. It has been around since 2015. Allegedly it is founded by Bitfinex. There are a few more out there, but we will focus on these as the biggest ones in market cap.

There has been a lot of controversy surrounding this coin in the past, including court cases. The main concern has been whether each coin is backed up by one dollar in the bank.

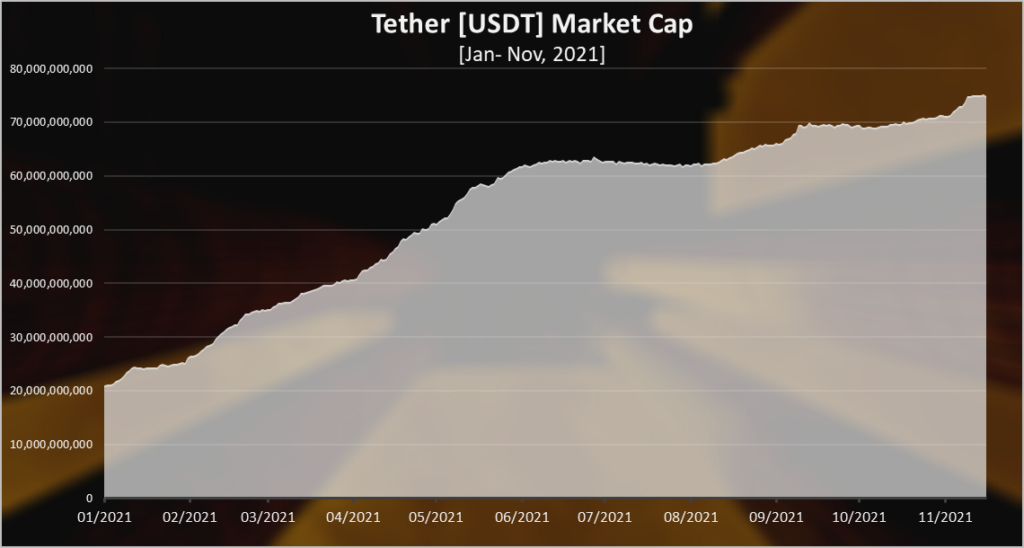

Here is the historical market cap for Tether

During the first half of 2021, Tether grew more aggressively and reached 60B in the June. After that, it decreased for a while and stopped growing entirely around August. The Tether market cap gradually increased after August and now is around 75B. Basically, this is during the period of correction and China banning miners.

USD Coin [USDC]

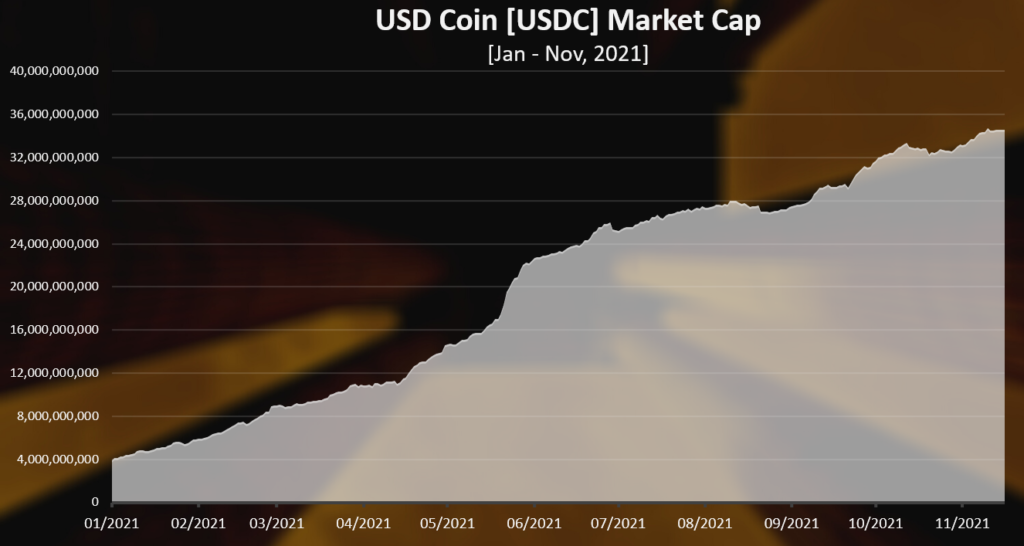

USDC is a coin that Coinbase and Circle are working on together. Its supply should be more credible. The chart below demonstrates this.

USDC has grown more than eight times in market capitalization in 2021 as well. At the beginning of the year, it had a market cap of around 4B, and now it has around 34B.

As with Tether, we can discern a similar trend, a fast growth in the first half, a slowdown in the summer during the market correction, and an upward trend in the last few months.

Binance USD [BUSD]

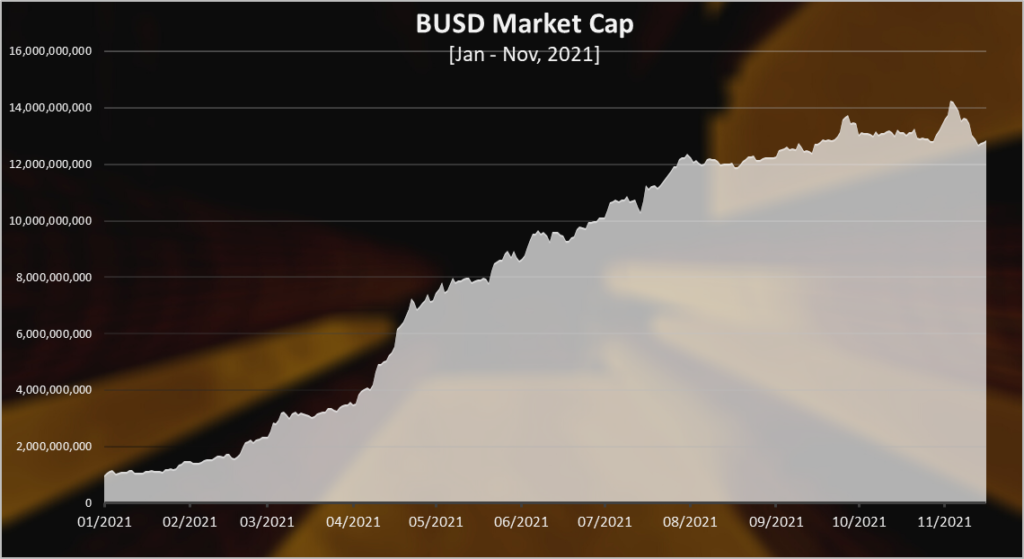

Stablecoin used on Binance and BSC. BUSD has grown very rapidly for the first half of the year, and then slowed down over the past two months. Earlier this year, the market cap of BUSD was just over one billion dollars, and now it is around 13 billion dollars.

Dai [DAI]

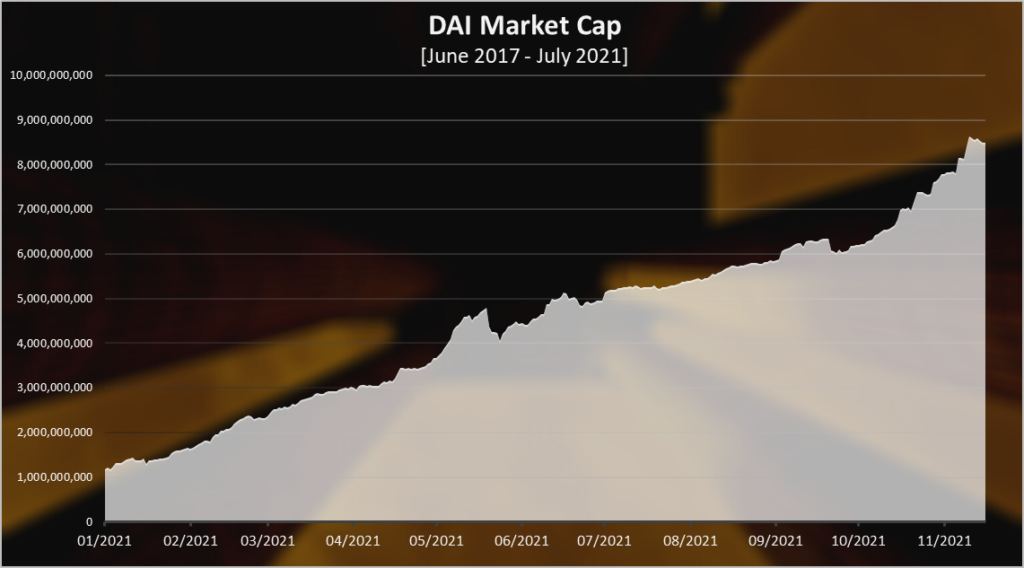

The MakerDAO protocol lets anyone deposit collateral, create collateral loans, and generate DAI as loans. DAI was developed later than USDT or USDC.

DAI’s current multilateral version started in January 2020. There was a previous version, a single-collateral version, that started in 2017.

Unlike the previous dollar collateralized stable coins, DAI has continued to grow well throughout 2021, with even higher growth in the second half. DAI started the year with around 1B in market cap and is now nearly 8B.

DAI is generated in a decentralized manner and collateral is locked in a smart contract. The collateral ratio is on average 3:1 with USDT, USDC, and BUSD. As a result, there is an approximate 3B collateral requirement for 1B DAI. A fractional reserve policy is not in place. The holders of the Maker governance token decide how much DAI is issued.

TerraUSD (UST)

A stablecoin backed by crypto, Terra stablecoin UST has seen some interesting developments in the last year. It is the closest competitor to DAI. In contrast to DAI, it works differently, with UST converted to LUNA as the platform’s main token, similar to HIVE and HBD.

The overcollateralization method used by DAI is much less capital efficient than this method for stablecoins.

2021 was the year in which UST established itself as a trustworthy stablecoin. It is the new kid among stablecoins. The year started with just a few hundred in market cap and now it is over 5 billion.

Interesting to note, there has been a massive increase of UST added to the market in the past few days. Not sure what is going on.

A Billion-Dollar Market: The Growing Value of Stablecoins

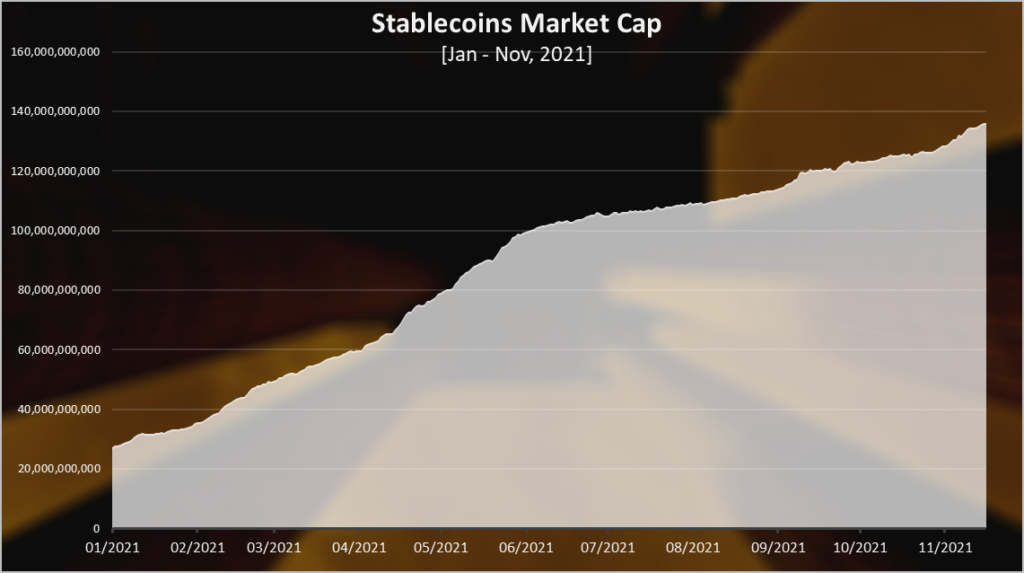

Here is the chart for the total market cap of stablecoins in 2021. The chart above includes the stablecoins from the previous list. There are some others but they make up 95% of the market.

More than 100 billion dollars have been added in less than a year to the overall market capitalization of stablecoins, up from 27 billion at the beginning of the year.

This is why stablecoins are number one on the regulatory list. Since the fed does not want any competition, stablecoins can cause a lot of regulatory problems.

If left unchecked, the company can also overextend itself.

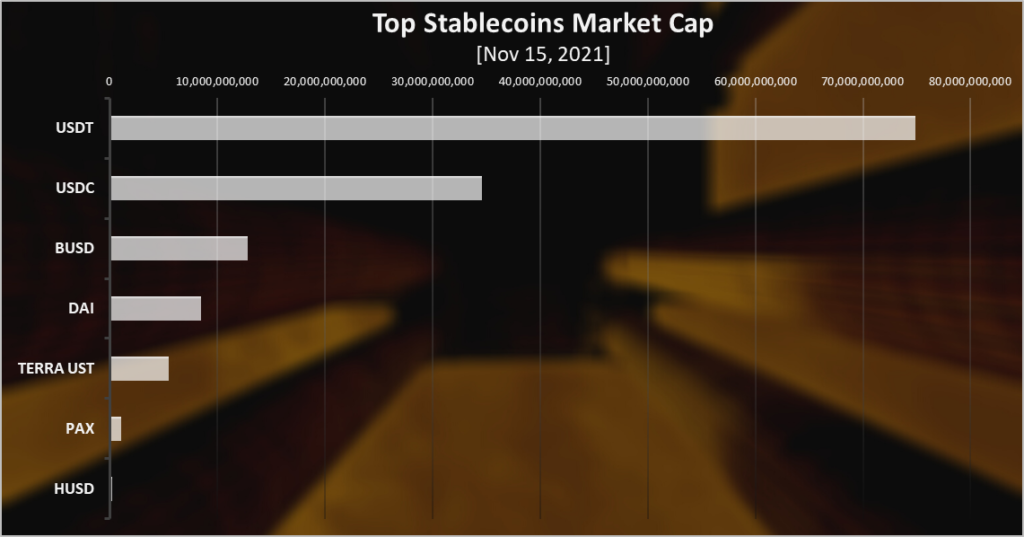

A Detailed Chart On The Latest Market Cap of the Top Stablecoins

Here is the chart for the latest market cap of the top stablecoins.

USDC is on the second spot with 34B (25%), followed by BUSD, DAI, and UST. Tether USDT dominates the stablecoin market, with 75B marketcap out of the total 136B.

Stablecoins have seen massive growth in 2021. Their market cap has risen by more than 100 billions of dollars. A general trend has been a rapid increase in the first half, a slowdown during the summer correction, and a slower increase in the last few months.

USDT, USDC and BUSD are the fiat backed stablecoins that are showing slightly different trends from DAI and UST. UST is the new contender in the stablecoin arena and is challenging DAI for the top spot.

HBD is currently valued at about $15 million, excluding DHF supply. If we compare this to the billions for the top stablecoins, we can see the potential. UST also works very similarly to HBD.

What stablecoin are you using?

Via this site.