The rejection follows some concern about the level of centralization in the MakerDAO network and whether it could lead to future monopolies or oligopolies. However, it does not appear that any proposal was particularly contentious or divisive, so much as there was a general agreement that decentralization is important for ensuring transparency and keeping the system accountable.

With the decentralized governance model in place, all MakerDAO users need to focus on building strong governance structures within their own organizations to ensure they are making decisions based on fact rather than fearmongering or agenda pushing. Initiatives like these can be useful as they help identify potential risks and vulnerabilities, but without proper governance systems in place it can also easily backfire without anyone even noticing until it’s too late.

A series of proposals would have seen the Dai (DAI) stablecoin’s governance structure become more centralized, but MakerDAO members rejected them in a major victory for decentralization. The final outcome will keep decentralization in place.

MakerDao rejected these proposals because they could have led to centralization of control over the network’s development and maintenance. MakerDAO is committed to decentralization and strong ecosystem governance as part of its decentralized vision.

On Monday, MakerDAO members attended a meeting to discuss three proposals to restructure the leadership structure of the decentralized autonomous organization (DAO) into something that resembles a corporation, complete with a board of directors.

The proposals were drafted to improve the efficiency of the DAO and make it more capable of executing “high-level decisions.” Another author and member of the MakerDAO Protocol Engineering Core Unit, Sam McPherson, expressed frustration with the current governance model, tweeting:

“The status quo is not working… The DAO is not currently set up to make high-level decisions which is leading to decision paralysis or less informed parties making sub-optimal calls.”

A new “oversight Core Unit” was proposed in LOVE-001. It was essentially a proposal to establish a unit that periodically audits the activities of other Core Units – a way of saying a more centralized authority would be able to exert additional control over collateral decisions.

There were 293,911 Maker (MKR)-delegated governance tokens used to vote against LOVE-001.

MakerDAO’s GitHub page states the second proposal, dubbed “Makershire Hathaway,” would create a 10-million-dollar special purpose fund to earn yield on the protocol’s stablecoin reserves. The Makershire Hathaway campaign was rejected by 65% of voters.

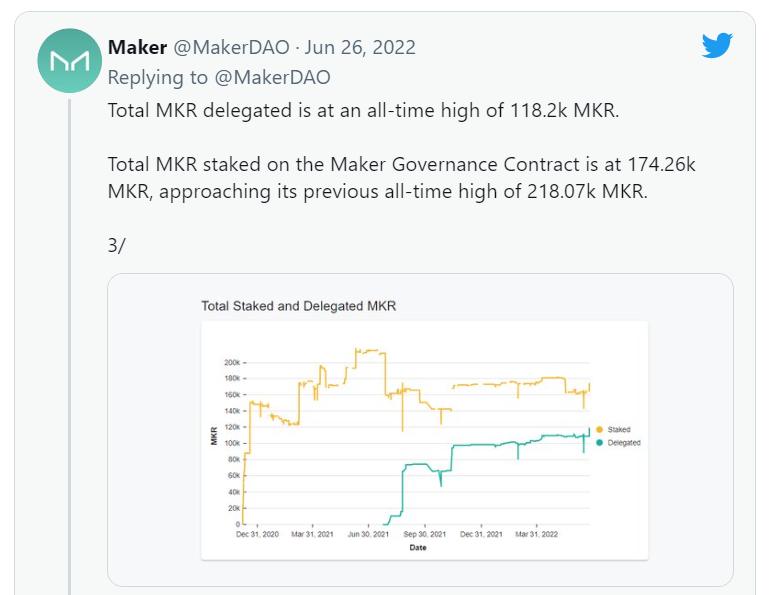

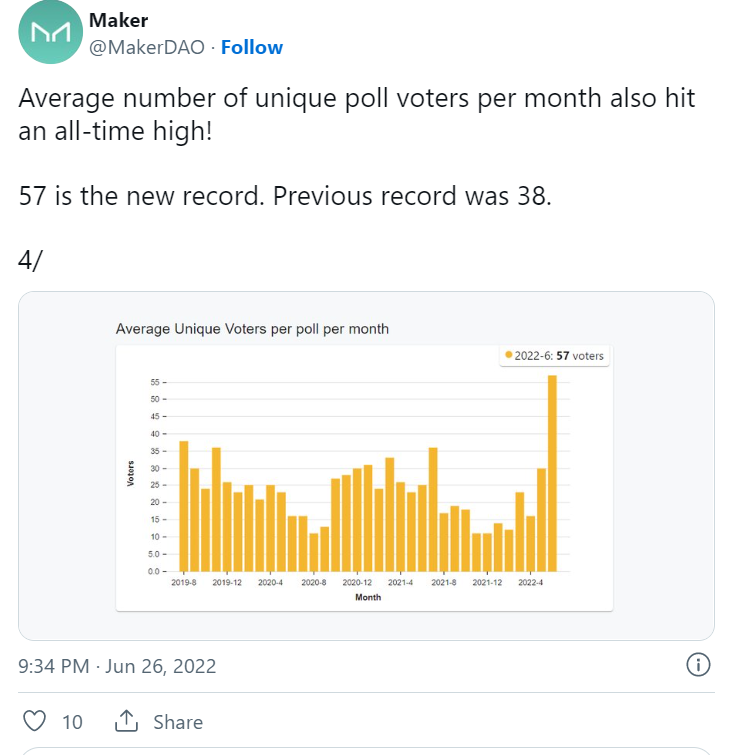

A third proposal, known only as MIP75c3-SP1, proposed the creation of a discretionary fund that would be overseen by a new “Growth Task Force” to accelerate Maker’s growth. This proposal received the most unilateral rejection, with over 76% of MKR voting against it. MakerDAO noted that the three proposals seemed to stir the pot, with the most governance voting activity seen so far.

Combined with the historic turnout, this rejection indicates MakerDAO members prefer a fully decentralized governance model, establishing a strong precedent for other decentralized finance (DeFi) protocols to follow.

In exchange for user deposits of Ethereum (ETH), Wrapped Bitcoin (wBTC), and nearly 30 other cryptocurrencies, MakerDAO issues United States dollar-pegged DAI stablecoins.

Another major milestone was reached this month when MakerDAO announced its intention to invest a portion of its dormant stablecoin reserves in traditional financial assets. Earlier this month, MakerDao voted to stop lending platform Aave from generating DAI for its lending pool without collateral as fears of DeFi contagion spread.

According to the Cointelegraph Price Index, Maker’s governance token MKR is currently trading at $880 despite a series of important developments for DeFi.

Via this site.